Have just reposted a posting by Willis Eschenbach at “Watts up with That”. Eschenbach contends what is lacking in the AGW argument is not just a coherent scientific case. It is also the proper verification and defence of the science. Predictive failures are ignored, and critics vilified.

I made the following comment on the blog.

Might I point out that you have left out a couple of stages?

It is necessary and but not sufficient to

1. Show a strong probability that extra-normal global warming will occur.

2. That if such warming occurs, that it will have catastrophic consequences – with likely impacts in extent and in place.

At this point the Climate Scientists pass the problem over to the economists.

3. Even, if you accept the disaster scenarios, there is no policy available that will contain CO2 at 2 or 3 degrees of further warming, without imposing greater costs on humanity that impose greater costs on humanity than the worst case scenarios. However, some will say that Stern solved this problem and showed this was theoretically possible. However, it was one that would work by hitting the poorest hardest.

4. Even if you accept that a mitigation policy is theoretically possible, it will only work if every country contains their emissions. If the rapidly growing countries, especially China and India, do not contain their emissions then the emissions- cutting of the West will be of no effect. Further, if the policies to not fall into Stern’s maximum cost of $80 per tonne of CO2 saved (The IPCC’s is much lower), then the policies are doing more harm than good.

So there are four stages of this justification – Forecast, consequences, policy and implementation. It is only the first two that the climate scientists have some competency.

Just because a doctor diagnoses a new condition does not give him the instant insight into the cure, nor the ability to know the dosage or the side-effects of any new medicine.

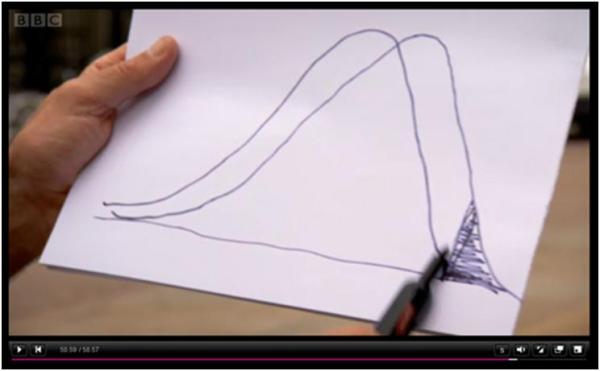

I hope to post a graphical explanation of the AGW case in the coming days or weeks.